Our finances

Contents

- Welcome from our Chair

- Resurging, innovating, and bringing people together

- Better volunteering for a stronger movement

- Our purpose and method

- Vision and strategic objectives

- Skills for Life: Our plan to prepare better futures 2018-2025

- Growth

- Inclusivity

- Youth Shaped

- Community Impact

- Three pillars of work

- Programme

- People

- Perception

- Theory of Change

- The impact of Scouts on young people

- Our finances

- Trustees’ responsibilities

- Independent Auditor’s Report to the Trustees of The Scout Association

- Consolidated statement of financial activities

- Balance sheet

- Statements of cash flows

- Our members

- How we operate

- Governance structure and Board membership – 1 April 2021 to 31 March 2022

- Our advisers

- Our thanks

- Investors in People

Our finances

Financial statements

The Association’s financial statements have been prepared in accordance with the Financial Reporting Standard applicable in the UK and Republic of Ireland (FRS 102), and the Statement of Recommended Practice, Accounting and Reporting by Charities, applicable to charities preparing their accounts in accordance with FRS 102 (known as the Charities SORP (FRS 102)) and the Charities Act 2011.

Consolidation

These accounts consolidate the results of The Scout Association and its six wholly owned trading subsidiaries:

- Scout Shops Limited (trading as Scout Store)

- Scout Insurance Services Limited (trading as Unity)

- Scout Services Limited

- Scout Products Limited

- Scout Insurance (Guernsey) Limited (to the date of liquidation – 9 December 2021)

- World Scout Shop Limited

The remaining subsidiary trading companies covenant their annual distributable profits to their parent charity, The Scout Association.

More information on these companies is included in note 12 to the financial statements.

2021/22 financial overview

This year has been a year of recovery with the return of face-to-face Scouting, and we’ve managed our finances well. At the forefront of our planning and actions, we’ve looked at how we keep Scouts going, and enable all our members to keep benefitting by acquiring skills for life.

We’ve been able to do that with the dedication of our volunteers, and the drive of our staff. We’ve benefited from the support of our corporate partners as well as various charitable Trusts and Foundations, which is really appreciated in furthering our work. We’re also grateful for the generosity of individual donors particularly in supporting our new section Squirrels, and our Race Round the World fundraising campaign.

During the year, we sold our investment property Baden-Powell House. This decision was made to strengthen our future cash position as we enter a period of recovery for the movement build our reserves, and continue delivering our strategy.

Now face-to-face Scouts has resumed, we can plan with more optimism. However, to keep financial security, we need to continue to make changes.

With that context, here’s a look back at the last year:

- Our finances came under severe strain, but we managed them effectively to support Scouts.

- Following the sale of Baden-Powell House we presented our plans to apply the proceeds, as previously outlined in last year’s reserves policy. This is to apply a portion to budgeted losses while membership numbers recover to previous levels; to recapitalise Scout Stores following its recent losses during the pandemic and consider further investments in commercial operations and Scout Adventures; to deliver specific projects in support of the Skills for Life strategy; to satisfy any revised funding requirements following the next pension fund triennial funding review.

- We raised our membership fee by £7.50 for 2021/22, and ring-fenced £1.50 of that to support groups in financial hardship. The majority of the funds raised by the additional £1.50 were distributed to Scout Groups adversely impacted by the pandemic, due to a decline in member numbers. There is a residual amount of £199k from these funds. There’s a clear three-year plan to build back and recover the membership numbers.

Financial results

The Association’s financial result reflects the activities mentioned above. The results for the year are shown in the Consolidated Statement of Financial Activities (SOFA) on page 40.

There was an operating deficit, before investment and pension valuation changes, of £0.3m for the year compared with the previous year’s surplus of £0.6m. The result is made up of an unrestricted deficit of £0.9m, with an increase of £0.6m in restricted funds.

Listed investment values fell giving a loss of £0.1m, compared with last year’s gain of £11.5m which reflected an uplift in the value of Baden-Powell House to its expected sales value. The sale for £46 million, was finally competed in August 2021.

There continues to be significant movements in the actuarial measurement of the defined benefit pension scheme deficit. This year’s £3.2m gain largely resulted from movement in the value of assets and liabilities in the scheme as also reflecting the movement in interest rates as compared to last year’s £0.4m loss.

Overall, the net movement in funds in the SOFA was £2.9m compared to £11.6m in 2021.

Income

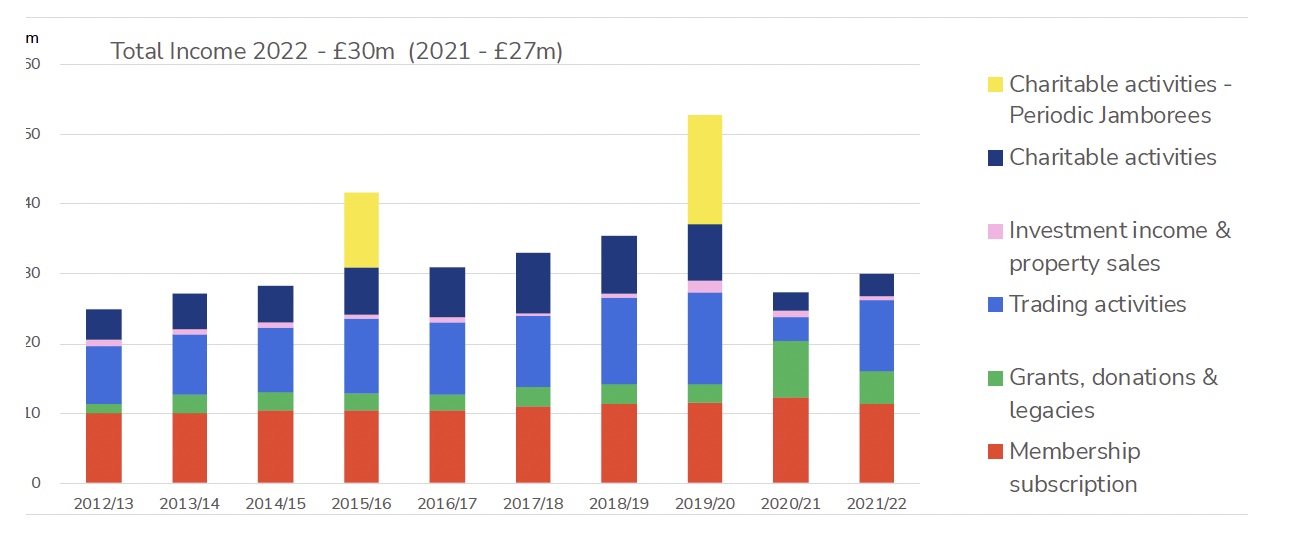

As shown in the graph below, total income for the year was £30.0m compared with £27.1m in 2021. The reasons are expanded on below.

Last year, we noted that the past consistency and robustness of our income streams was now more uncertain. This 10-year graph shows the impact of the loss of income from activity centres, shop trading and conference centres last year, and the recovery we have made in 2021/22, especially in Scout Stores.

Our member subscriptions are key for funding the support provided to members. Particularly with increasing safeguarding costs, the Trustees agreed a £7.50 increase in fees for 2021/22. The fee is paid for youth members only; adult members and members of Network are not required to pay a National Fee. There was a decrease in youth members of just under 7%, and with the fee increase, member subscriptions decreased by £0.9m to £11.3m.

The continued and generous support of our donors is important and greatly appreciated by the Association. Despite the hard, uncertain economic conditions, legacies and donations increased by £1.0m to £3.0m.

We were successful in lobbying for more government support for the youth sector, which led to the creation of the Youth COVID Support. This fund helps services to remain viable since they provide vital support to young people.

Income from charitable activities is received from our activity centres and sales linked to our charitable purposes. These include camping, training, activities, and accommodation charges at Gilwell Park and the other National Scout Adventure Centres. With the easing of lockdown and increased face-to- face Scouts, this income saw a slight increase when compared to 2020/21. Charitable activities also includes insurance commissions earned by Unity Insurance, which also improved. There was an increase in charitable income of £0.8m to £3.2m.

Our trading operations include the retail sales made by Scout Shops Limited and World Scout Shop Limited, and sponsorship and promotional income.

Shops activity has improved, with sales up from £2.4m to £9.1m.

We’ve continued to establish strong links with corporate sponsors and brought in £0.9m from these beneficial connections, up £0.1m on the previous year.

Investment income increased slightly by £0.1m to £0.6m.

Expenditure

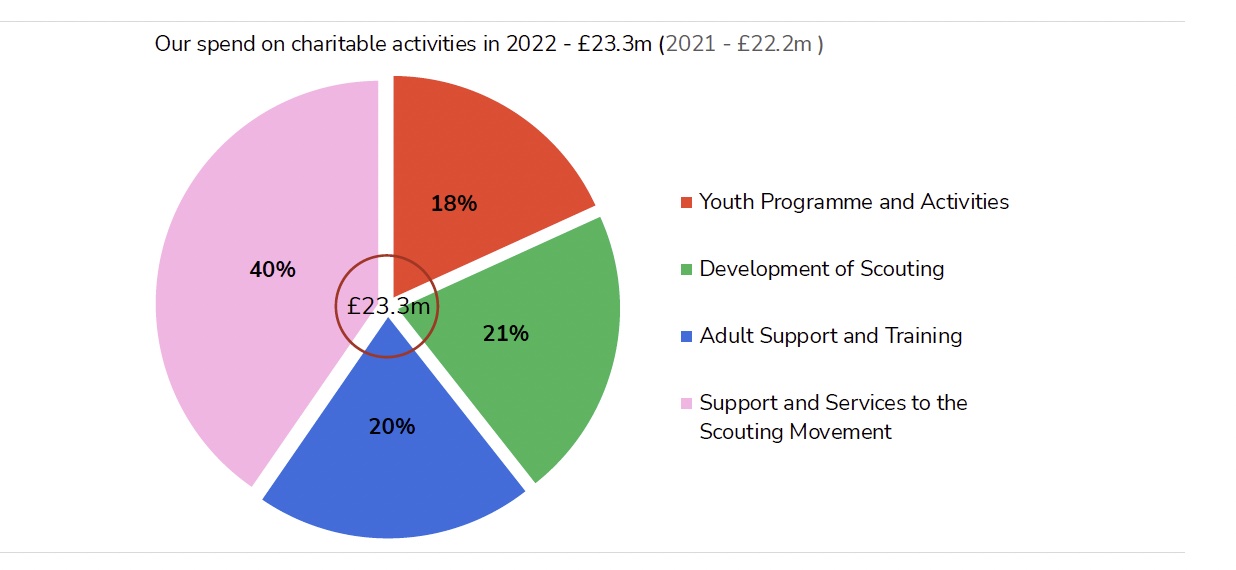

Total expenditure was £30.2m compared with the previous year of £26.5m, an increase of £3.7m. Our spend on charitable activities was £23.3m, which was up on 20/21 by £1.1m. This is shown in the pie chart on page 33 under our activity headings, followed by a description of what we provide and achieve through these activities.

Youth programme and activities

We know Scouts is needed more than ever, so we adapted our programme over the past year to make as many face-to-face activities as possible. Over 1,200 activities are now available on our website, including a large number of lockdown-suitable activities. We’re making a conscious effort to retain the blend of digital, indoor, and outdoor activities going forwards, as we’re aware these will be helpful for young people post-pandemic, too.

Development of Scouting

Despite losing many adult and youth members during 20/21, we are already seeing a strong return of youth members. The 16% growth in youth members is the greatest we’ve seen since World War Two.

We launched a new section, Squirrels, to extend Scouts to 4 to 6-year-olds. We’ve already created 600 sections, and by 2033, we hope to welcome 130,000 4 to 6-year-olds per annum, supported by 40,000 new adult volunteers.

This, along with our national volunteer recruitment campaign #GoodForYou and commitment to improving volunteer experience, means we remain optimistic about our growth goals and the bright future of Scouts.

Adult support and training

Our adult volunteers have been amazing this year, and we’ve done our best to support them in the way they deserve.

We moved our inclusion support and events online, providing members with guidance, lived experience panels, expert speakers, and new programme ideas.

To make sure the crucial early stages of a volunteer’s journey with us are the best they can be, we also began a partnership with Girlguiding, generously funded by Pears Foundation. This partnership is helping us improve the volunteer welcome journey, making it smoother and easier for all.

In addition, we now have a continuous review process for our web content and our essential training. This makes sure both are clear and useful for our volunteers. As part of this, we’re offering a ‘blended learning’ approach: digital first, but with workshops and ‘on the job’ learning, too.

Support and service to members

This year, we continued focusing on supporting members and communities most affected by COVID-19.

Our four strategic objectives – Growth, Inclusivity, Youth Shaped and Community Impact – are fulfilled by activities in these four areas. Many of the actions and activities delivering strategic objectives are led by volunteers, with proportionately less financial expenditure than activities delivered by our salaried staff. Due to this, the Trustees feel these four headings used to analyse charitable activities provide a more meaningful and appropriate explanation of our income and expenditure.

Charity funds

The Scout Association’s consolidated funds increased by £2.9m to £88.3m as of 31 March 2022. The value of endowment funds was £2.2m, restricted funds £4.0m, designated funds £25.9m, the pension reserve £(1.4)m, trading funds £0.4m, and general funds were £57.2m.

All funds are described in more detail in note 19 to the financial statements with analysis of the movements in the year.

Reserves policy

The Trustees annually review the reserves policy. They continue planning to hold reserves to protect the Association and delivery of its charitable programmes by allowing time to adjust to changing financial circumstances. Reserves are also held to support the development of Scouts. The policy ensures an equitable balance between spending the maximum amount of income raised as soon as reasonably possible after receipt, while maintaining an appropriate level of reserves for the uninterrupted operation of the charity. It also provides parameters for future budgeting and strategic plans, and contributes towards decision making.

The reserves policy establishes an appropriate target for the level of general ‘free’ reserves. The target is based on a risk assessment of the probability and likely financial impact on the Association’s activities of unforeseen but possible events. This might be caused for example by a sudden decline in income coupled with an inability to reduce expenditure in the short term or a significant increase in litigation costs. The pandemic highlighted the risks to The Scout Association of short-term reductions in membership and commercial income due to the curtailment of face-to-face Scouts. At the same time it was essential to maintain member services to support such Scouting activities as were permissible and to maintain the nucleus of the movement to support future recovery. Consequently, the Trustees have determined that the appropriate free reserves target for The Scout Association is about one year’s worth of expenditure together with some medium term protection for the likely level of litigation taking into account the available commercial insurance cover. Combined this totals currently about £28m.

The general free reserves for The Scout Association itself shown as of 31 March 2022 are £57.2m (excluding the reserve for the pension fund deficit). However, Trustees recognise there are a number of factors which will likely significantly reduce the free reserves over the next few years. In particular:

- Budgeted losses while membership numbers recover to previous levels.

- Potential impacts from the next pension fund triennial funding review and changes in pension regulation due in 2022, which may accelerate the funding requirements.

- Further investment in commercial operations and Scout Adventures.

After considering the above allocations, the residual funds will be deployed in delivering the Skills for Life strategy, and further investments will be made for delivering services to the movement. We’ll keep the movement informed as plans for these investments develop over the coming year.

Forward financial forecast and going concern

The Trustees have considered the financial plans for the budget year of 2022/23 and projections for the following two years, looking at the cash and reserve projections. This covers a period of at least 12 months from the signing of these financial statements.

The proactive actions initiated, and the clear plans for resurgence and growth of membership, provide a route to growth and stability of the finances of The Scout Association. The sale of assets has provided us with the resources to maintain a sustainable operating model and invest in growing our services. Our income streams, such as membership income and commercial revenues, are growing. We’ve cut costs and controlled them in line with income, while protecting critical safeguarding and safety functions and frontline support to volunteers.

There’ll be future changes and there are residual risks. Over the short-term, though, we have the capacity to manage such exposures, as well as planning, monitoring, and managing cash flows accordingly.

We set out the charity’s risk management approach, as well as the key risks faced, on page 68. Despite the volatility of social, economic and market conditions, the pension deficit has reduced over recent years, and a deficit plan agreed with the Pension Scheme Trustees is included in our budget.

Taking all of the above into account, the Trustees have a reasonable expectation that the charity has adequate resources to continue operating for the foreseeable future. Accordingly, they believe the going concern basis remains the appropriate approach for preparing the financial statements for preparing the financial statements.

Fixed assets

Capital investment plans were held back during the year, as we took stock of how we invested in infrastructure to support our strategic objectives and members. As we looked at our future use of properties, spend was limited to making sure we maintained safety compliance.

Subsidiary companies

The Association’s trading subsidiaries are reviewed below. Each company is wholly owned and each – other than Scout Insurance (Guernsey) Limited, which was incorporated in the Bailiwick of Guernsey – is incorporated in England and Wales.

Scout Shops Limited

Scout Store sells Scouts uniform and ancillary products mainly to members of The Scout Association, both directly and through District Scout Stores and other wholesale outlets. With the return of face-to-face Scouting, Scout Shops had a good year by way of turnover and margins. Turnover increased to £9.1m (2021: £2.2m) with the impact of the lockdown. 2019 sales were increased by the World Scout Jamboree. Profit before taxation for the year was £3.2m (2021: loss of £0.8m). With this gain, the parent charity agreed to a profit retention of £976,000 at 31 March 2022 to strengthen the balance sheet. The remaining profit of £2.0m after tax has been covenanted to The Scout Association.

World Scout Shop Limited

Turnover of £0.2m remained the same as it was in the previous year, with a small gain of £0.01m (2021: loss of £0.01m). Scout Insurance Services Limited Scout Insurance Services trades under the name of Unity Insurance Services. Its main activity is insurance broker, providing services primarily to The Scout Association, the Scout movement, to other charities and not-for-profit organisations, including Girlguiding UK. In the year to March 2022, turnover was £2.5m (2021: £2.2m) with a profit before tax of £1.0m (2021: £1.1m), which it covenanted to The Scout Association. Scout Insurance (Guernsey) Limited Following the decision to wind up the operations and dissolve Scout Insurance (Guernsey) Limited, the assets and liabilities of the company were transferred back to The Scout Association in December 2021.

Scout Insurance Services Limited

Scout Insurance Services trades under the name of Unity Insurance Services. Its main activity is insurance broker, providing services primarily to The Scout Association, the Scout movement, to other charities and not-for-profit organisations, including Girlguiding UK.

In the year to March 2022, turnover was £2.5m (2021: £2.2m) with a profit before tax of £1.0m (2021: £1.1m), which it covenanted to The Scout Association.

Scout Insurance (Guernsey) Limited

Following the decision to wind up the operations and dissolve Scout Insurance (Guernsey) Limited, the assets and liabilities of the company were transferred back to The Scout Association in December 2021. Prior to liquidation a loss of £0.4m was made.

Scout Services Limited

Scout Services Limited’s principal activities are sponsorship and marketing services for The Scout Association, including the provision of conference facilities.

With the enforced closure of the Gilwell Park and Baden-Powell House conference centres, there was a review of their long-term benefit and profitability. The decision led to the sale of Baden-Powell House.

Scout Services Limited produced a net gain of £0.2m (2021: loss of £0.8m) from turnover of £1.0m (2021: £1.0m)

Scout Products Limited

Scout Products Limited produced a net gain of £3k from turnover of £94k.

The Scout Association Defined Benefit Pension Scheme

The most recent full actuarial valuation of The Scout Association Defined Benefit Pension Scheme was carried out as of 31 March 2019. The valuation showed a deficit of £6.5m and a funding level of 86%, which is an improvement from the 78% funding level at the March 2016 full valuation. Based on this valuation, the Trustees agreed a deficit recovery plan aimed at clearing the deficit by 2028. The Scheme closed to new members in the year ended 31 March 2001. During the year, process was completed to withdraw all current live members in the scheme, and this will be completed by June 2022.

In the year to March 2022, the Scout Association contributed £0.6m to the Scheme (2021: £0.7m ). The Trustees regularly monitor the Scheme funding deficit to make sure general reserves provide adequate cover against the future liability.

In accordance with Charity Commission guidance (‘Charity Reserves and Defined Benefit Pension Schemes’), the Trustees have reviewed the cash flow impact on the general reserves of the planned funding of the deficit, and these are included in the charity’s budget.

The valuation of the Defined Benefit Pension Scheme at 31 March 2022 for the accounting purposes of Financial Reporting Standard 102 (FRS 102) showed a deficit of £1.4m (2021: £4.9m).

Investment policy and performance

Since 2018, the fixed asset investments representing the targeted reserves have been held in the Cazenove Charity Multi-Asset Fund, which is ethically screened.

Following the decision to increase the reserves target and after the sale of Baden-Powell House in the current year, we carried out a tender exercise to appoint another fund manager, Sarasin, to hold additional funds in an investment portfolio.

The performance objectives are:

- To maintain an optimum level of income tempered by the need for capital growth in order to safeguard future grant-making capacity,

- And on a total return basis to outperform CPI + 4% on a rolling three-year basis

The Association’s current asset investments represent cash holdings held in Royal London Asset Management Funds, on behalf of the Short Term Investment Service provided to the movement. As of 31 March 2022, total deposits by Scout Groups, Districts, Counties and Regions in the Short Term Investment Service were £11.2m (2021: £11.1m). We’ll be reviewing the operation of the Short Term Investment Service during the coming year.

Remuneration policy

The Trustees consider that the Board of Trustees and the Executive Leadership Team (the Chief Executive and the Directors) comprise the key management personnel of the Charity.

All Trustees give their time freely, and no Trustee received remuneration in the year. The Chief Executive (who is also a Trustee and a full member of the Board) is paid for his executive duties only.

Details of Trustees’ expenses and related party transactions are disclosed in note 6c to the financial statements.

The remuneration of the senior staff is reviewed annually by the People and Culture Committee (a subcommittee of the Board), considering market conditions, cost of living increases and the financial position of the organisation. The salaries of the Executive Leadership Team are benchmarked to make sure they’re commensurate with the size of the roles.

The Executive Leadership Team members are entitled to employer pension contributions, and other benefits that are available to employees generally. In addition, enhanced medical insurance provision is provided.

The Executive Leadership Team sets the salaries for all other employees.

The remuneration benchmark is the mid-point of the range paid for similar roles, although a market rate supplement may also be paid where appropriate.